I was stunned when I heard a client decided to pay cash for an $800,000 solar installation.

I asked Ashish if he was prepared for a $75,000 a year increase in company tax. I could hear his jaw hit the floor!

Of course, what he did not consider is the fact every dollar of savings on electricity is going to fall straight to his bottom line and increase his company’s taxable income.

Added to this was the fact he could only depreciate the solar asset over 20 years leaving him with almost no deductions against the new profits.

He is paying back to the government the full amount of his solar rebate and more with a poor selection of finance.

Here are hard facts commercial solar sales people will not tell you

- If you pay cash you could repay your solar rebate many times over in increased company tax

- If you borrow money, as a business loan or a chattel mortgage, your repayments are NOT tax deductible – only your interest is deductible – making the situation even worse

The consequences

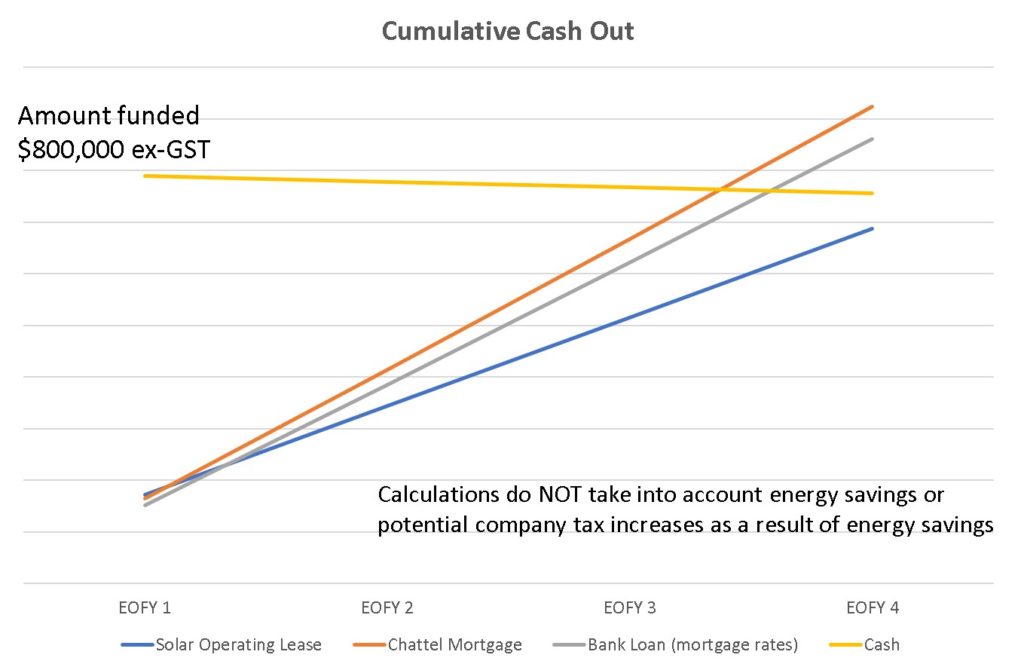

In this case the poor selection of finance (cash) may cost the business an additional $369,000 over four years compared to alternative solutions.

If he had used an operating lease for the $800,000 system, the out of pocket, over four years, is likely to be $686,308 taking into account tax and including a transfer of ownership fee of 5% at the end of term.

By paying cash, he locked away $800,000 for four years and is likely to have an out of pocket of $756,000 taking into account tax rules PLUS a potential $300,000 in increased company tax

If he was to obtain a business loan at mortgage rates for the $800,000 system the cash out, over the same four years, is likely to be $860,735 taking into account tax rules PLUS the potential $300,000 in increased company tax

If he was to obtain asset finance with a chattel mortgage at market rates for the $800,000 system the cash out, over four years, is likely to be $923,940 taking into account tax rules PLUS a potential $300,000 in increased company tax

Why the difference?

With an operating lease all payments made are 100% tax deductible and GST is claimable on the BAS statement. This means a tax paying business will simply replace one operating expense (electricity) with another smaller operating expense (operating lease payments).

There is no other asset a business can install which will come close to making as much of an impact on the bottom line as solar and energy storage. With the Tax Office classifying the operating life of solar as 20 years the impact of paying cash, or using any other finance type, can be very significant.

The Solution

For solar the ideal finance solution is an operating lease where your business replaces one operating expense with a smaller operating expense minimising the tax burden and maximising cash-flow.

If you have the cash put it in a bank cash management account and take out a solar operating lease. Your business will thank you for it.

Contact ASM Money or your local ASM Money broker

(03) 8595-0900

#all figures quoted are ex-GST. This article is general in nature and not financial advice. Please discuss your situation with your financial advisor before acting.